The Company announced an updated Mineral Resource Estimate for Niblack in February 2023. The resource estimate was conducted by Arseneau Consulting Services (“ACS”) and is reported within the guidelines of the Canadian Securities Administration National Instrument 43-101 (“NI 43-101”). ACS carried out database verification, grade shell geometry, and variography; utilizing a resource drill hole database with a total of 57,891 meters of sampling from 197 drill holes. Mineral resources were estimated in a single three-dimensional block model using Geovia Gems version 6.8.4 software. Precious and base metal grades within the mineralized domains were estimated in three successive passes by ordinary kriging for the Lookout deposit and by inverse distance squared interpolation for the Trio deposit. Search parameters were generally set to match the correlogram parameters but also designed to capture sufficient data to estimate a grade in the blocks. All assays were composited to 2.0 m and capped at the 97 or 98 percentiles before estimation.

The Indicated and Inferred mineral resources were classified according to the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definition Standards for Mineral Resources and Mineral Reserves by Dr. Gilles Arseneau, P.Geo., of ACS, a “qualified person” as defined by NI 43-101. The Company intends to publish an updated technical report within 45 days of this news release which will include the resource estimate. The report will be available at that time on SEDAR and the Company’s website.

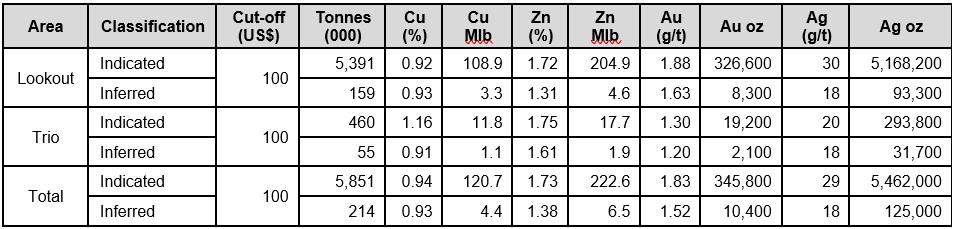

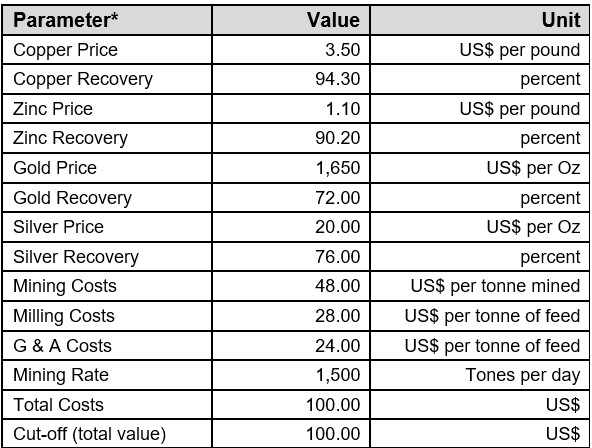

All Indicated and Inferred resources were categorized as meeting “reasonable prospects for eventual economic extraction” by underground methods utilizing a stope optimizer and 5m x 5m x 5m block model at a US$100 dollar equivalent value cut-off. The Mineral Resource Statement and assumptions and economic parameters used to calculate the resource are presented in Tables 1 and 2 below:

Table 1: Updated Niblack Mineral Resource Statement, February 16, 2023

(1) Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

(2) The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

(3) The Inferred Mineral Resource in this estimated has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(4) The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves. Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

(5) Numbers may not add up due to rounding.

(6) Metal prices are derived from the London Energy & Metals Consensus Forecast. Recoveries are derived from preliminary metallurgical test work on Niblack and operating costs are derived from benchmarking against similar deposits in Alaska and assuming longhole stope mining methods. See Table 2 for details.

Table 2: Parameters used to derive the "reasonable prospect of eventual economic extraction" for Underground Mining Conditions

Note*: Metal prices are derived from the London Energy & Metals Consensus Forecast. Recoveries are derived from preliminary metallurgical tests and are assumed to be 100% payable. Operating costs are derived from benchmarking against similar deposits in Alaska and assuming longhole stoping mining methods.

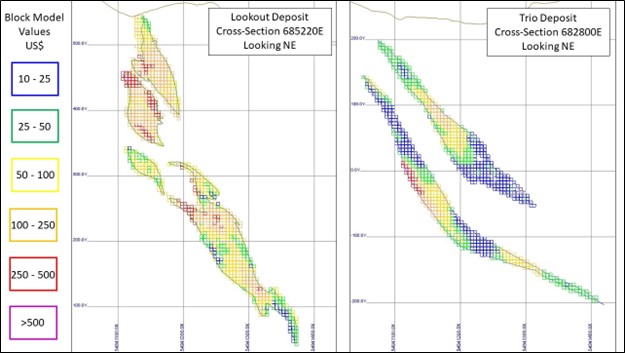

Figure 1: Oblique View of the Block Models for the Lookout and Trio Deposits

Figure 2: Cross Sections of Lookout and Trio showing the Updated Resource Block Model