February 24th 2021, Vancouver, BC – Heatherdale Resources Ltd. (“Heatherdale” or the “Company”) (TSXV: HTR) announces that Ausenco Canada Ltd. (“Ausenco”) has completed a detailed review of previous metallurgical testwork and has commenced a Phase I metallurgical optimization program for Heatherdale’s 100%-owned Niblack copper-gold-silver-zinc project, located at tidewater in southeast Alaska.

“The review of previous metallurgical work demonstrates great recoveries for copper and zinc, producing clean concentrates. The coarse-grained nature of the polymetallic massive-sulphide mineralization at Niblack occurs in deposits up to 100 meters wide, potentially amenable to low-impact, bulk underground mining techniques and conventional flotation is a big advantage of this project,” said Rob McLeod, President and CEO of Heatherdale. “We look forward to recommencing drilling next month with two underground rigs, while we wait for drill assays from the Phase I program, which are now expected in April of 2021”.

Results from work completed by SGS Labs in 2009, Niblack mineralization respond very well to flotation achieving good concentrate grades and recoveries with only two cleaning stages for copper and zinc, with improving gold (72%) and silver (76%) recoveries in concentrates. Precious metals at Niblack occur primarily as electrum and tellurides, which are ideal for future optimization work. Two composites were tested, representative of potential life of mine (“LOM”), plus high-grade (“HG”) zones within; open cycle tests results were confirmed on locked cycle test (“LCT”) for each of the two samples. The LCT details are summarized on Table 1 below.

| LOM Sample (anticipated life of mine grade) |

HG Sample (higher grade zone within deposit) |

||||||

|---|---|---|---|---|---|---|---|

|

Head grade (Direct assay) |

|||||||

|

|

|

|

||||

|

Locked Cycle Test Results |

|||||||

|

|

||||||

|

Grind size - P80 (80% passing size) |

|||||||

|

Primary: 64 µm |

Copper Regrind: 33 µm |

Zinc Regrind: 41 µm |

Primary: 68 µm |

Copper Regrind: 41 µm |

Zinc Regrind: 49 µm |

||

Table 1 - Summary of LCT results (Source: SGS 2009)

In 2020, Heatherdale engaged Ausenco Engineering Canada Inc. to complete a review of previously completed metallurgical testwork with the objective of identifying opportunities to improve the recoveries for gold and silver. The Niblack deposit contains gold content that is noticeably higher than the average for volcanogenic systems, which presents an opportunity to add significant value through improved recovery methods. Following the completion of the review, Ausenco has made several recommendations for additional metallurgical testwork, which form the basis of the Phase I program.

“We look forward to further work with Ausenco, a global leader in providing engineering services to the mining sector,” said Ryan Weymark, VP – Project Development of Heatherdale. “Heatherdale is focused on maximizing the value of the Niblack Project through implementing a value-focused approach; the objective of the upcoming program will include maximizing gold and silver recoveries that could compliment the strong recoveries already shown for copper and zinc. Future metallurgical testwork will also include the known mineralization with material from the ongoing exploration program, that is focused on expanding the high-grade Niblack resource and new zones along the over five-kilometer-long prospective host-rock horizon.”

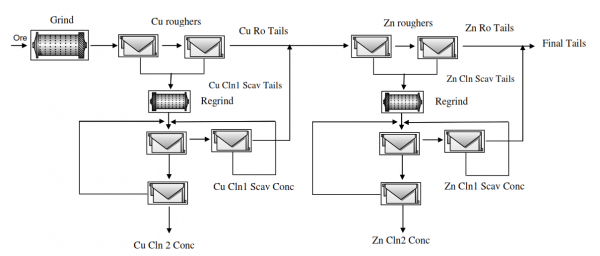

Previous Metallurgical Testwork

Previous metallurgical test programs have been completed at the Niblack Project by Placer Dome’s Metallurgical Research Centre (1990), Met Engineer’s Ltd. on behalf of Abacus (1997) and SGS Metallurgy (2008/2009) – as summarized in the November 2011 NI 43-101 Report authored by SRK Consulting. The metallurgical testwork completed by SGS Metallurgy was based on two samples, representing the average LOM grade and a HG composite. The results of the SGS testwork indicate strong recoveries of copper to the copper concentrate and zinc to the zinc concentrate, as outlined in Table 2 and Figure 1:]

Table 2: SGS Metallurgical Test Results (Source: 2011 NI 43-101 Report, SRK)

The key highlights of Ausenco’s review of the previously completed metallurgical testwork include:

- Most gold and silver losses were associated to the rougher tails. Low penalty element concentration was observed in copper concentrate for both composites with very clean zinc concentrate.

- The primary minerals of interest for the Niblack Project are chalcopyrite, sphalerite, electrum and gold and silver tellurides. The precious metals of interest are gold and silver. Use of alternative collectors may improve the recovery of precious metals from electrum and tellurides. A finer primary grind size should improve the revenues from precious metals.

- A metal correlation analysis completed for the samples available for testing indicates considerable variability of mineral assemblage.

- A preliminary heterogeneity analysis indicates the Niblack deposit is amenable to ore preconcentration. The results show potential to reject up to 40% of mass with minimal loss of copper and gold with ore preconcentration.

Figure 1 - Niblack processing flowsheet (Source: SGS 2009)

Phase I Metallurgical Program

The Company has commenced the Phase I metallurgical testwork program, managed by Ausenco to investigate multiple opportunities identified during their initial review including to improve gold and silver recoveries. Based on the results of Ausenco’s review, the following is recommended for the program:

- Complete a more in-depth desktop bulk ore sorting analysis.

- Test dithiophosphate collectors and other collectors to improve precious metal recovery.

- Conduct further primary grind size optimisation test work to maximize precious metals recovery to copper concentrate.

- Test finer regrind size after assessing changes in collector and primary grind size.

- Test pyrite flotation to better quantify opportunities to optimize tailings disposal.

- Conduct comminution tests after the flotation grind sizes are confirmed.

- Test variability of the deposit using discrete samples and geo-metallurgy composites to de-risk the project and allow for more flexibility on project optimization.

QA/QC and Qualified Persons

Robert McLeod, P.Geo, President and CEO of Heatherdale Resources Ltd and Ryan Weymark, P.Eng., Vice President of Project Development have reviewed and approved the technical content of this release. Both are ‘Qualified Persons’ under NI 43-101.

About Heatherdale Resources

Heatherdale Resources Ltd.’s founding vision is to be an industry leader in transparency, inclusion and innovation. Guided by our Vision and through collaboration with local and Indigenous communities and stakeholders, Heatherdale builds shareholder value through our technical expertise in mineral exploration, engineering and permitting. The Company holds a 100% interest in the high-grade Niblack copper-gold-zinc-silver VMS project, located adjacent to tidewater in southeast Alaska. For more information on Heatherdale, please visit the Company’s website at www.heatherdaleresources.com.

On behalf of the Board of Directors

“Robert McLeod”

Robert McLeod, P.Geo

President, CEO and Director

For more information, contact:

Rob McLeod

604-617-0616 (Mobile)

604-343-2997 (Office)

rm@bwcg.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements:

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would” or “occur”. This information and these statements, referred to herein as “forward‐looking statements”, are not historical facts, are made as of the date of this news release. Forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company’s securities; and changes in the Company’s business plans. In making the forward looking statements in this news release, the Company has applied several material assumptions that the Company believes are reasonable, including without limitation, that the Company will continue with its stated business objectives. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. The Company seeks safe harbor.

The Company’s “Mineral Resource Estimate” refers to a November 2011 NI 43-101 Report authored by SRK Consulting Independent of the Company and Deon Van Der Heever, Pr. Sci. Nat., Hunter Dickinson Inc., a Qualified Person who was not independent of the Company. Net Smelter Return (NSR) cutoff uses long-term metal forecasts: gold US$1,150/oz, silver US$20.00/oz, copper US$2.50/lb, and zinc US$1.00/lb; Recoveries (used for all NSR calculations) to Cu concentrate of 95% Cu, 56% Au and 53% Ag with payable metal factors of 96.5% for Cu, 90.7% for Au, and 89.5% for Ag; to Zn concentrate of 93% Zn, 16% Au, and 24% Ag with payable metal factors of 85% for Zn, 80% for Au and 20% for Ag. Detailed engineering studies will determine the best cutoff.

For more information on the Company, investors should review the Company’s continuous disclosure filings that are available at www.sedar.com.